Are you considering investing in Lloyds Engineering Works Ltd? If so, you’re in the right place to gather some insightful information before making a decision. As with any investment, it’s essential to conduct thorough research to understand the company’s history, financial health, and future prospects. In this comprehensive guide, we will delve into various aspects of Lloyds Engineering Works Ltd shares to equip you with the necessary knowledge for informed decision-making.

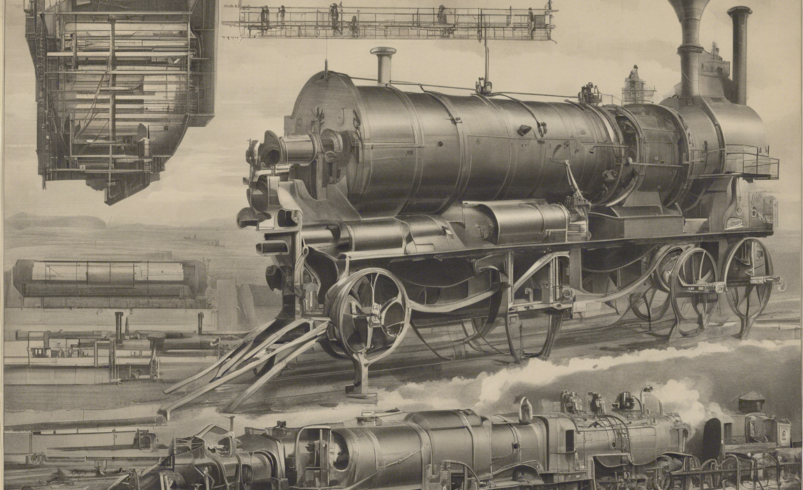

Company Overview

Lloyds Engineering Works Ltd, founded in [year], is a renowned player in the engineering industry, specializing in [specific segment]. Over the years, the company has established itself as a key player in the market, known for its [unique selling points].

Financial Performance

Before investing in any company, it’s crucial to analyze its financial performance. Lloyds Engineering Works Ltd’s financial statements provide valuable insights into its revenue, profits, and overall financial health. By examining key financial ratios like return on equity (ROE), debt-to-equity ratio, and earnings per share (EPS), investors can gauge the company’s efficiency, leverage, and profitability.

Industry Analysis

Understanding the broader industry dynamics is essential when evaluating a company’s shares. Factors such as market demand, competitive landscape, and regulatory environment can significantly impact a company’s performance. Conducting a thorough analysis of the engineering sector can help investors anticipate market trends and make informed decisions regarding Lloyds Engineering Works Ltd shares.

Growth Prospects

Assessing a company’s growth prospects is crucial for long-term investors. Factors such as expansion plans, new product development, and market penetration can provide insights into a company’s future performance. Examining Lloyds Engineering Works Ltd’s growth strategy and market positioning can help investors evaluate its potential for sustainable growth.

Risk Factors

All investments come with inherent risks, and it’s essential to identify and evaluate these risks before investing in a company’s shares. Factors such as market volatility, regulatory changes, and competition can pose significant risks to Lloyds Engineering Works Ltd’s share price. Conducting a comprehensive risk assessment can help investors mitigate potential downsides and make well-informed investment decisions.

Dividend Policy

For income-seeking investors, understanding a company’s dividend policy is critical. Lloyds Engineering Works Ltd’s dividend history, dividend yield, and payout ratio can provide insights into its commitment to rewarding shareholders. Evaluating the company’s dividend track record can help investors assess the potential income stream from their investment in Lloyds Engineering Works Ltd shares.

Analyst Recommendations

Analyst recommendations offer valuable insights into a company’s stock performance and future outlook. By reviewing analyst reports, price targets, and earnings forecasts, investors can benefit from expert opinions on Lloyds Engineering Works Ltd shares. While it’s essential to conduct independent research, analyst recommendations can complement your investment analysis and decision-making process.

Frequently Asked Questions (FAQs)

- Is Lloyds Engineering Works Ltd a publicly traded company?

-

Yes, Lloyds Engineering Works Ltd is a publicly traded company listed on [stock exchange].

-

What is the current stock price of Lloyds Engineering Works Ltd?

-

The current stock price of Lloyds Engineering Works Ltd can be checked on financial news websites or through a stock market app.

-

Does Lloyds Engineering Works Ltd pay dividends?

-

Lloyds Engineering Works Ltd’s dividend policy and history can be found in its financial reports and investor relations materials.

-

How can I stay updated on Lloyds Engineering Works Ltd’s financial performance?

-

Investors can monitor Lloyds Engineering Works Ltd’s financial performance through its quarterly and annual reports, investor presentations, and stock market news.

-

What are some key competitors of Lloyds Engineering Works Ltd in the engineering industry?

- Key competitors of Lloyds Engineering Works Ltd in the engineering industry include [competitor 1], [competitor 2], and [competitor 3].

In conclusion, investing in Lloyds Engineering Works Ltd shares requires careful consideration of various factors, including the company’s financial performance, growth prospects, risk factors, dividend policy, and analyst recommendations. By conducting thorough research and staying informed about the engineering industry, investors can make well-informed decisions regarding their investment in Lloyds Engineering Works Ltd shares. Remember, investing in the stock market carries risks, and it’s essential to seek professional financial advice before making any investment decisions.